Pay Per Click (PPC) for Financial Services

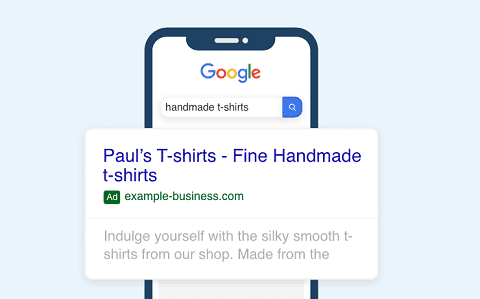

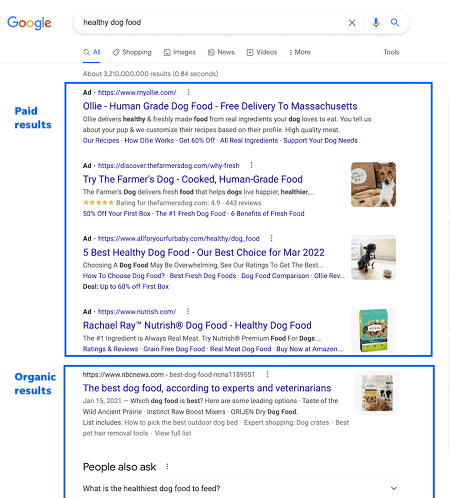

PPC is a type of online advertising whereby advertisers only pay for actual clicks on their digital ads (ad impressions are free). PPC allows you to reach new potential clients. A PPC campaign will guarantee your results on the search engine result page (SERP) of clients making specific, active searches.

We help the financial and capital markets generate leads with our highly targeted PPC campaigns. Enjoy cost-effective PPC strategies and campaign management for Financial Services that drive leads and maximise ROI

Frequently Asked Questions

Financial advisors need PPC campaigns to gain online exposure, achieve thought leadership, attract quality leads, and increase sales. Financial advisor ads are essential for attaining your marketing goals. It lands you in front of those who matter most to your business when you effectively implement a google ads campaign..

PPC is a form of paid advertising strategy for financial advisors. The advertisers pay a fee whenever someone clicks on their PPC ads and visits their website. It is a worthwhile investment since the visit generates more than the click is worth. PPC campaign aims to influence a specific type of user action, including purchases and registration.

At PPC Services India we can also offer Financial Advisor lead generation packages, if this sounds like something you would be interested in check out the page.

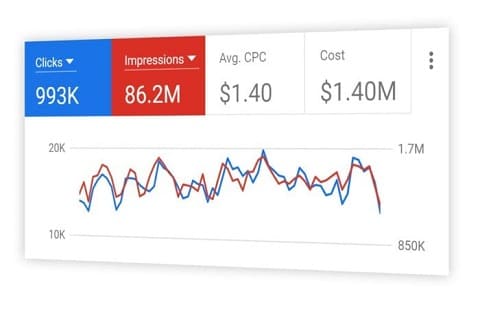

The average cost of PPC for financial advisors in the UK cost about 200 to 300 pounds per month. This figure can vary based on keyword popularity, cost per click, the level of competition in your area, quality score, and volume of ads. In some cases, business owners pay a specific percentage of the total ads spent, which ranges from 15 to 25 per cent.

1. Understand the regulations

Financial products and services are highly regulated industries. This is why Google suggests that, when creating ads, you make sure to comply with local, state and national regulations. This may include specific disclosures that provide transparency to the product or services highlighted by the ad. Google and other search engines may also require specific information within the ad for it to be approved, such as:

- Disclosure of associated fees

- Contact information and physical location

- Links for implied third-party endorsement or accreditation

Personal loan advertising must also contain info about the quality, fees, features, benefits, and risks associated with the product. The idea is that these disclosures provide valuable information to help consumers make informed decisions. When creating an ad, make sure your content contains:

- Annual Percentage Rate (APR)

- Minimum and maximum repayment period

- An example representing the total cost of the loan, including applicable fees

2. Know the financial products Google won’t accept

Google doesn’t allow advertisers to promote a variety of financial products, including:

- Short-term loans (loans that require full repayment within 60 days)

- High APR personal loans

- Trading binary options or similar products

- Complex speculative financial products

- Credit repair services

Advertising for loan modifications, debt services, and cryptocurrencies is allowed, but there are strict rules. If you’re planning PPC for financial services in these areas, review the guidelines carefully. Luckily, if your ad is not approved, Google provides guidance for what you can do to fix the issues.

3. Start paid search marketing slowly

Whether you’re experienced in PPC or are new to paid search, starting slowly can help ensure you get the most efficient results possible.

Start with one to three campaigns and a core group of four to ten keywords, then measure the results after a few weeks or so. You’ll see where your budget is being spent most effectively so you can cut the underperforming ads, continue to iterate, and put more effort towards what’s working.

4. Prepare for higher cost per click (CPC)

Financial keywords are competitive. When it comes to digital marketing for financial services, this often translates into a higher cost than for other industries. Focus keywords in your niche rather than the industry as a whole to help attract the most qualified leads, and leverage negative keywords when it makes sense to weed out unqualified leads. If you need help with keyword research, PPCService provides PPC marketing services to help build a winning keyword strategy.

5. Know your audience targeting options

If your company has physical locations in a few areas, tightly focused search engine marketing can help you make the most of your budget. In addition to targeting by geographic location, you were once able to can take advantage of other demographic options such as age, gender, household income, and more.

The more specific you are, the easier it will be to find your ideal target audience. For example, if you want to attract management-level consumers, use income levels, which should still be permitted. This can help you find the clients that want your products in a sea of those who aren’t the right fit for one reason or another.

6. Create original copy

To stand out from the crowd in the financial services industry, you’ve got to get creative. By writing unique copy that features offers and benefits, you can increase click-through rates (CTR) and attract the right consumers.

For example, if you’re developing PPC for credit unions, credit cards or banking institutions, you may want to promote offerings like no annual fees or 24/7 customer service. If your campaign revolves around insurance company products, what perks or savings can you offer? Create a call to action (CTA) that stands out, catches the consumer’s eye, and inspires them to click.

7. Customize landing pages

If your ad simply goes to your company’s homepage, your campaign isn’t primed to convert. Keep conversion rates high by making sure the link on your ad goes to an optimized landing page that has the matching content.

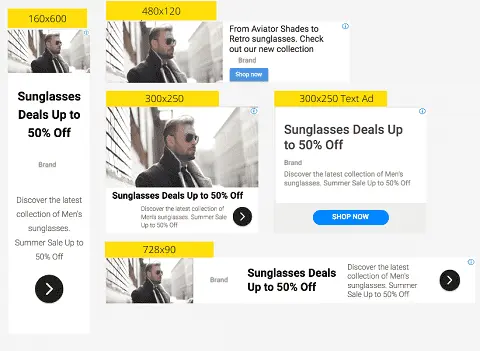

8. Leverage display advertising

Sure, the requirements for advertising may be strict. But millions of consumers need financial products — from help with tax preparation, retirement, and home equity loans to auto insurance and basic banking accounts.

Display advertising offers several options to improve engagement and boost conversion rates:

- Behavioral

- Contextual

- Geographical

- Site-specific

Types of display ads include static, animated, interactive, video, and expanding.

Display ad best practices

The marketing strategy for an insurance company, banking institution, or financial products group must have the right mix of elements to be successful (no surprise there). Here are a few proven best practices to consider when creating your campaigns:

- Go local: Localize your ad to make your interactions more relevant. Use familiar local terms and graphics to increase messaging and conversion rates.

- Make it actionable: Consider adding a call to action (CTA) message or button to the banner itself to help inspire people to click for more.

- Add a focused hero image: If your product benefits a particular audience, use images that resonate with that specific consumer. For example, a happy young family in a yard for first-time homeowners may resonate better than a generic stock image of a wallet.

- Build trust: Fear and uncertainty are common emotions associated with financial decision-making. Keep the message simple and repeat it, since most consumers need to see an ad several times before they believe it, without fear-mongering. Add any certificates or recognized local customers to establish trust.

- Combine search marketing with display: Display ads increase brand recognition. As more consumers become aware of your product, they’ll search for it as they move through their decision-making process. As the search numbers increase, your search engine ranking improves, which can result in more sales.

9. Test, adjust, and test again

Take your PPC insurance, loan, or banking campaign’s search marketing results to the next level by testing individual components. Start by auditing keywords for funding value, rather than for leads or conversions, to help you score the highest return on investment.

A/B testing can illuminate which ad elements resonate most with your audience. You can test things like the images, headlines, and ad copy by running two ads simultaneously. Just make sure you only test one element per A/B test so you can accurately pinpoint results.

10. Test, adjust, and test again

Take your PPC insurance, loan, or banking campaign’s search marketing results to the next level by testing individual components. Start by auditing keywords for funding value, rather than for leads or conversions, to help you score the highest return on investment.

A/B testing can illuminate which ad elements resonate most with your audience. You can test things like the images, headlines, and ad copy by running two ads simultaneously. Just make sure you only test one element per A/B test so you can accurately pinpoint results.

PPC costs can vary based on campaign size, demographic targeting, length of the campaign, and the ads you’re making. While the average PPC across all sectors is a little under $3.00, the exact amount will vary greatly.

Banks must adhere to strict rules when advertising so it’s essential to use the right strategies to ensure affordability and profitability. PPC is a quick way to attract qualified leads to your site thanks to the hyper-specific targeting. Comparatively, SEO (search engine optimisation) is a long-term growth strategy. Both are effective and we can help you determine which suits your business goals better.

PPC SERVICES : Drive Sales With PPC Management Services

Pay-per-click (PPC) management services provide a professional service to manage your PPC campaign and strategy for a set fee.

PPC Management Services

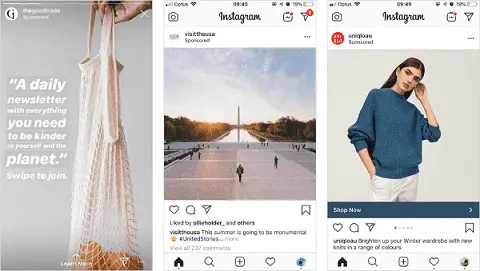

Pay-Per-Click (PPC) management services are a form of advertising in which a service provider is hired to run advertisements on search engines, social media platforms, and other relevant channels in order to drive traffic to a website through click-through rates and/or website visits. A Pay-Per-Click management agency is aware of the objectives of its client and is committed to helping them reach their buyers, regardless of whether they are running Google Ads, Facebook Ads, or other forms of advertising.

Contact us

Remarketing Ads

Ads for remarketing are displayed to people who have visited your website and expressed interest in buying. With accurate audience segmentation and analytics, we can show you the ads for real-time products that people have actually viewed. With such a high-intent audience, our strategic remarketing strategy is perfect for following up.

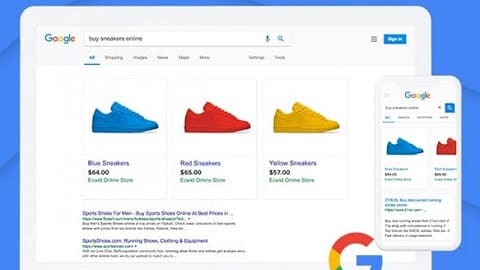

Google Shopping Ads

Google Shopping Ads (also known as Google PLA Ads or Google Shopping Ads) are an ideal tool for ecommerce and online retail businesses, as they are displayed in the carousel above the natural search results and in the shopping section of Google's GDN. This allows ecommerce companies to quickly rank their products at the forefront of Google's search results pages.

In-stream Ads

In-stream advertisements are also referred to as YouTube ads. Pay-per-click (PPC) ads are displayed on the search results page of YouTube, on YouTube videos, and on Display Network video partners. YouTube ads showcase your brand in a distinctive and memorable manner. In-stream ads have recently been introduced on Facebook, enabling businesses to position advertisements in the optimal slots and natural interruptions in video content.

Local Services Ads

Local service ads work on a pay-per-click (PPC) model. That means you’re not paying for clicks that aren’t leads. Local service advertising is only available in a handful of markets. HVAC company, electrician, plumber and locksmith are just a few examples. Our local service PPC firm works with local providers to increase the visibility of their businesses to their target audience.

Gmail Sponsored Promotions (GSP)

One of the most widely used forms of advertising in Gmail is GSP, which was launched in 2015. GSP (Gmail Sponsored Promotion) allows recipients to send a customised message to a specific recipient. GSP is a form of advertising provided by Google, which is advertising that is placed directly in the inbox of the Gmail user.